The HR-Powered Workforce Development Journey: Upskilling Financial Advisors for Growth and Retention

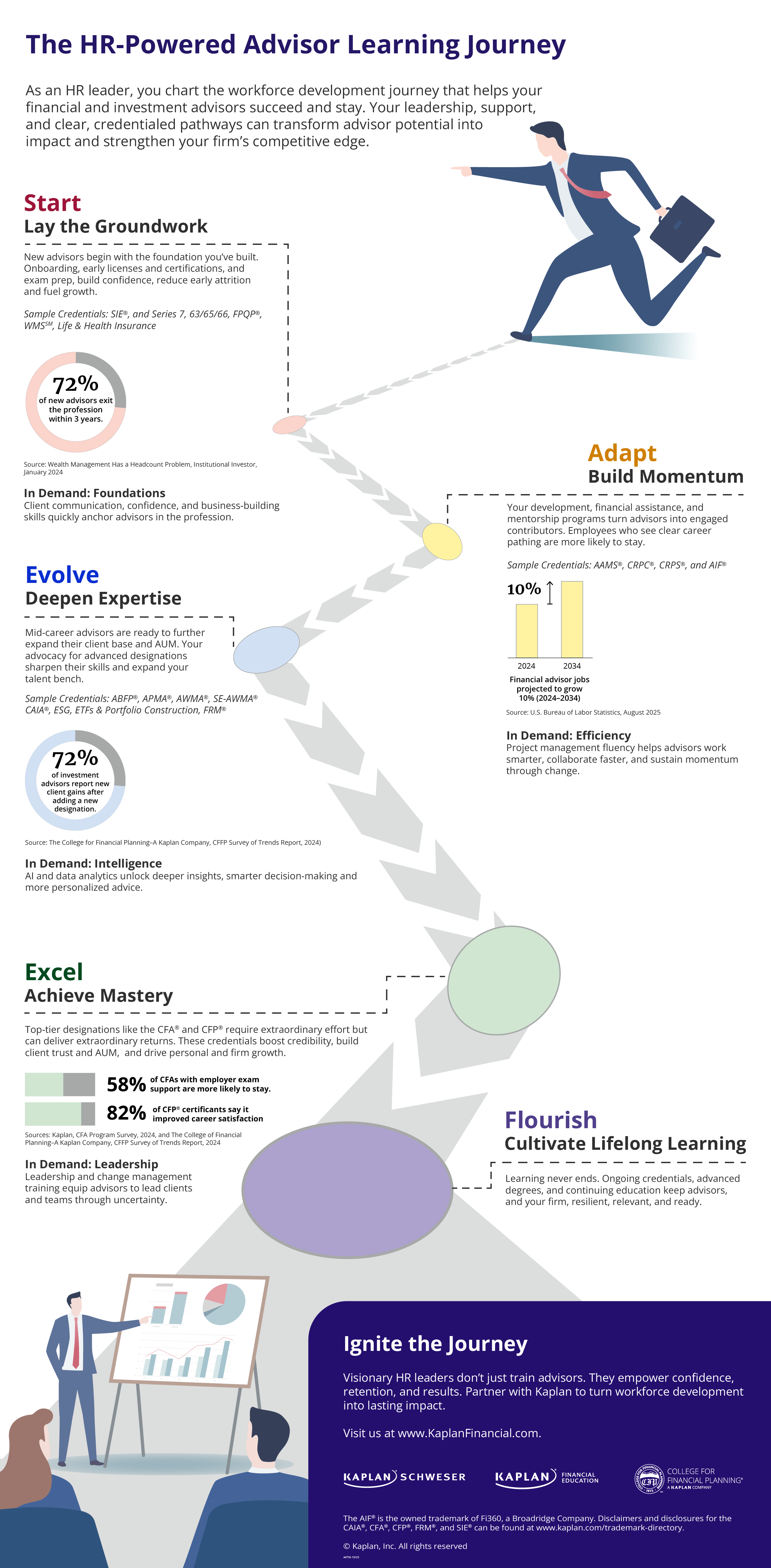

When HR integrates credential-based learning pathways and skill development into workforce planning, it transforms education into measurable outcomes. These outcomes include higher retention, faster time-to-productivity, and expanded assets under management. This article details how to construct an effective advisor workforce development journey across career stages to impact firm performance.

Download our development journey infographic for a comprehensive look at this strategic approach and transforming workforce development into firm performance.

1. How should firms support new financial advisors in their first year?

The first year sets the tone for success. Foundational credentials such as the SIE®, Series 7/63/65/66, FPQP®, and WMSSM help advisors build confidence and meet regulatory requirements. Structured onboarding that integrates exam prep, mentoring, and clear role expectations keeps early turnover low.

2. How can firms build momentum for mid-career advisors?

Once advisors establish foundational competence, development is ready to evolve. Consider career pathing, mentorship, and firm support for credentials such as AAMS®, CRPC®, CRPS®, and AIF®. These designations deepen planning and fiduciary skills while signaling long-term opportunity.

3. Which advanced credentials expand advisor expertise and client impact?

Encourage experienced advisors to pursue specializations that elevate their analytical and advisory skills. Credentials such as ABFP®, APMA®, AWMA®, SE-AWMA®, CAIA®, FRM®, and ESG credentials develop portfolio sophistication, alternative-investment fluency, and risk-management capability.

Learn Why Alternative Investment Education Is the Next Competitive Advantage By Downloading Our White Paper

How do elite certifications like CFA® and CFP® affect advisor retention and leadership?

High-level designations like the CFA® and CFP® require substantial dedication, yet this commitment delivers powerful outcomes for both advisors and the firm. The specialized knowledge gained reflects an advisor’s deep expertise and commitment to the profession, proving critical for expanding client bases and increasing assets under management.

5. What skills matter most across an advisor’s career journey?

Advisor success hinges on an evolving blend of soft and technical skills. In early career stages, a focus on confidence, communication, client trust-building, and business development can get new advisors off to a strong start. As advisors advance in their careers, efficiency, time and project management, and collaboration may prove vital alongside AI and data-driven insights. Integrating these dynamic skill sets into career development helps firms cultivate well-rounded professionals capable of adapting to market changes.

6. How can firms sustain long-term advisor growth?

Continuous learning is the differentiator. Encourage and track ongoing CE. Promote graduate study, and emerging-skills training in analytics, ESG investing, and AI-driven portfolio management. Firms that embed lifelong learning into culture stay resilient, relevant, and ready for what’s next.

7. What do all of these credential acronyms stand for and what do they mean?

Here’s a sample guide and cheat sheet for reference.

Acronym | Credential Name | Focus Area |

| AAMS® | Accredited Asset Management Specialist | Portfolio construction |

| ABFP® | Accredited Behavioral Finance Professional | Investor psychology |

| AIF® | Accredited Investment Fiduciary | Fiduciary standards |

| APMA® | Accredited Portfolio Management Advisor | Advanced portfolio design |

| AWMA® / SE-AWMA® | Accredited Wealth Management Advisor / Sports & Entertainment | High-net-worth clients |

| CAIA® | Chartered Alternative Investment Analyst | Alternatives & private markets |

| CFA® | Chartered Financial Analyst | Global investment analysis |

| CFP® | Certified Financial Planner | Comprehensive planning |

| CRPC® | Chartered Retirement Planning Counselor | Retirement strategies |

| CRPS® | Chartered Retirement Plans Specialist | Employer plan design |

| FPQP® | Financial Paraplanner Qualified Professional | Client support basics |

| FRM® | Financial Risk Manager | Risk management |

| Series 7/63/65/66 | FINRA Licensing Exams | Core investment roles |

| SIE | Securities Industry Essentials | Foundational licensing |

| WMSSM | Wealth Management Specialist | Investment fundamentals |