Business Articles

The Great Wealth Transfer is Already Stress-Testing Your Talent System

“The Great Wealth Transfer” is often framed as a market moment. However, inside financial firms, it is fundamentally a workforce challenge: Can your advisors successfully retain the heirs/beneficiaries? Do you have sufficient advisor capacity to manage the influx of new wealth and clients?

A projected $124T is set to transfer from one generation to the next through 2048, according to Cerulli & Associates ($105T to heirs and $18T to charity, estimated). While this estimate varies based on modeling and time span, the operational reality remains: the client base is shifting, expectations are evolving, and the workforce is aging.

If you manage talent and workforce development in wealth management, this is not background noise. It represents a critical, looming capability gap and a significant challenge for clients and assets under management (AUM) retention.

For HR and compliance leaders, the urgent question is: How do you validate and operationalize nextgen asset management expertise at scale?

The “Great Wealth Leak”

Most firms serve current clients well, but those relationships become precarious during the handoff.

When wealth changes hands, heirs frequently reassess every aspect of the relationship: the advisor, the service model, the fees, the digital experience, and the alignment of values. Practically speaking, a decades-long relationship can be severed in a matter of weeks.

You have likely seen this scenario play out:

- Parents have a strong connection with the advisor

- Heirs barely know the advisor

- The first interaction occurs during a moment of heightened emotion: grief, estate stress, and/or family conflict

- An heir states: “We already have someone we trust.“

This is the start of the “Great Wealth Leak.“ Sometimes it’s a dramatic, “pop!” Other times it’s a slow drift of assets to another advisory firm or advisor.

Some analyses suggest that extreme attrition claims are overstated or highly segmented (by advice model, wealth tier, and relationship depth). Even assuming a lower asset attrition rate, however, the risk remains significant enough that waiting for certainty is a precarious choice.

The Looming Advisor Shortage and Talent Gap

Even if heirs retained every dollar with your firm, the “workforce math“ alone would necessitate action.

McKinsey estimates that about 38% of current financial advisors will retire in the next ten years. This looming capacity crisis, according to McKinsey, is further intensified by the fact that heirs are increasingly looking for younger and female advisors. This demand for new advisors is therefore both generational and gender-specific. While retirement projections may differ, the consistent storyline is that the industry cannot simply “hire its way out.“

Crucially, the wealth manager and financial advisor pipelines are distinct from other talent funnels. The path from training to full productivity is protracted, often complicated by compliance requirements and the need for rigorous licensure and certifications.

As a people leader, you are simultaneously managing two reinforcing problems:

- Retaining heirs, and

- Building sufficient numbers of properly licensed and certified advisors quickly enough.

This combination is precisely why the Great Wealth Transfer constitutes a workforce crisis.

What Younger Clients Expect and Your Service Model May Not Yet Deliver

Preparing for the Great Wealth Transfer is not about chasing a trend; it is about ensuring you are ready to meet the expectations of your (hopefully) new clients. Broadly speaking, younger clients often demand:

- Speed and clarity. This generation, shaped by digital fluency, will expect timely follow-up and transparency.

- An easy digital experience. Having a portal is insufficient; it must be intuitive and seamless.

- Planning that aligns with their lives. Advisors should be prepared to advise on equity compensation, student loan debt, early-stage wealth decisions, career planning, family complexity, and managing multiple accounts across various platforms.

And their values. This cohort of investors holds strong opinions regarding where they are willing to invest their money, whether that focus is on ESG, philanthropy, or private equity.

Here is the uncomfortable truth: often firms attempt to solve these challenges with messaging rather than capability building, proclaiming, “we have a modern platform!” instead of, “our advisors have demonstrable and validated expertise in these new areas.”

Workforce development is critical: this is a capability problem that must be proven to the nextgen client.

Make NextGen Retention a Defined Capability

The coming demand is unambiguous. Preparation for the Great Wealth Transfer should become a defined job requirement, and that requirement must include external validation. This entails identifying the necessary skills, ensuring advisors earn the credentials that signal their expertise, and tying those validated skills to career progression and staffing decisions.

1. New wealth management competencies

Advisors must be comfortable with, and ready for, the topics heirs are likely to raise first: taxes, student debt, early-stage investing, alternative investments, multi-generational planning structures, 529 plans, ESG investing, and more.

2. AI fluency

AI does not retain clients—humans do. However, tools that support the advisor in providing a positive client experience can help. A Human+AI approach can increase responsiveness, communication, and transparency. Technology and training in AI fluency can buy back time for the human work of listening, guiding, and educating.

3. Family dynamics

Inheritance involves more than just finances; it includes grief, complex family dynamics, and more. Advisors require practical experience running family meetings, navigating conflict, and communicating with multiple stakeholders. While these may be framed as “soft“ or “durable“ skills, they are also vital “nextgen client retention” skills.

External Validation Is the Key to Trust and AUM Retention

The transition from one generation of wealth to the next is a moment of profound uncertainty for the heir. Designations and certifications are the most powerful tool to mitigate client anxiety by signaling a comprehensive, independently verified expertise that is relevant to their modern lives.

Credentials cannot stand alone, however. They must be paired with a comprehensive “nextgen advising readiness” career pathway, incorporating mastery of areas such as ESG, behavioral finance, alternative investments, AI-fluency, and family dynamics. Completion of a high-value credential should be made a fundamental requirement for advisors who manage transfer-risk relationships.

Credentials and career readiness send a clear signal to both your clients and your own workforce that you are constructing the framework necessary to successfully navigate the “Great Wealth Transfer.”

The ROI: Credentialing as AUM Retention Infrastructure

Leadership often equates “training“ with “costs.“ Yet, preparing for nextgen clients with validated expertise is not an expense—it is the creation of an AUM retention infrastructure.

The cost to upskill an advisor is modest when compared to the long-term value of maintaining a multi-generational relationship. Furthermore, the benefits of credentials are not merely defensive; they are catalysts for growth:

- Stronger referrals

- Better recruiting outcomes

- Improved succession plans

Certifications and other upskilling are necessary to protect future revenue, not merely an operational expense to support career growth.

Build an Inheritable Relationship

This initiative is larger than isolated training; it is the creation of a lasting client and people retention framework. With trillions of dollars poised to change hands and a large portion of the workforce nearing retirement, the firms that successfully retain nextgen clients, or woo them from competitors, will be the ones whose validated expertise is synonymous with trust.

The next generation won’t inherit the advisor relationship unless the advisor relationship is built to be inherited.

Build a lasting client, AUM, and people retention infrastructure with Kaplan’s new Professional Generational Wealth Transfer Advisor℠ (PGWTA℠) designation. Discover how to make the PGWTA℠ part of your talent strategy. Connect with us.

Your 90-Day AUM and Advisor Retention Roadmap

To immediately begin closing critical skills gaps and securing NextGen clients, this 90-day framework helps HR and L&D leaders go from diagnosing exposure to rolling out a retention infrastructure. This is your roadmap to ensuring your advisors have the proven skills necessary to earn the trust of heirs and beneficiaries.

Days 0–30: Get Clarity & Buy-In

Pinpoint the biggest risks and define what success will look like

- Identify your most-exposed client relationships (where the wealth transfer is likely to happen soon).

- Set a "NextGen Readiness" standard that requires external validation as the final step.

- Audit advisor retirement timelines and pipeline gaps to reframe the urgency for leadership

- Lock in the metrics you’ll use to measure success: Percentage of heirs engaged, advisors who met the validated baseline, and retention rates.

Days 31–60: Launch the “Retention Skills Curriculum”

Get the right training and credentials into your advisor pipelines.

- Run a focused 6–8 week “Credentialing Readiness Sprint” aimed at external validation.

- Design learning paths for new, mid-career, and senior advisors, making a high-value credential the mandatory capstone.

- Implement manager reinforcement (coaching guides, observation checklists, and client-conversation practice sessions.

- Determine which NextGen skills require external, third-party validation to best protect AUM.

Days 61–90: Roll Out, Implement, and Show ROI

Put the new models in place and prove the business case.

- Pilot the credentialing requirement with high-value cohorts to quickly measure and prove AUM retention and impact.

- Create a transition playbook for advisors introducing themselves to heirs, running family meetings, and sharing relationship ownership.

- Formalize a team model for at-risk books of business: pair legacy trust with NextGen fluency and credentialed expertise

- Report on ROI in clear business terms: AUM retained, households engaged, and the advisor capability lift proven by external validation/credentialing.

Written by Kaplan experts, reviewed by Sara Stolberg Berkowicz, Ph.D., CFP®, ABFP℠, CDFA®, CRPC℠, CRPS℠, CSRIC℠, SE-AWMA. Dr. Berkowicz is Chair of the Professional Designations Department and an award-winning professor at the College for Financial Planning®—A Kaplan Company, as well as a published author.

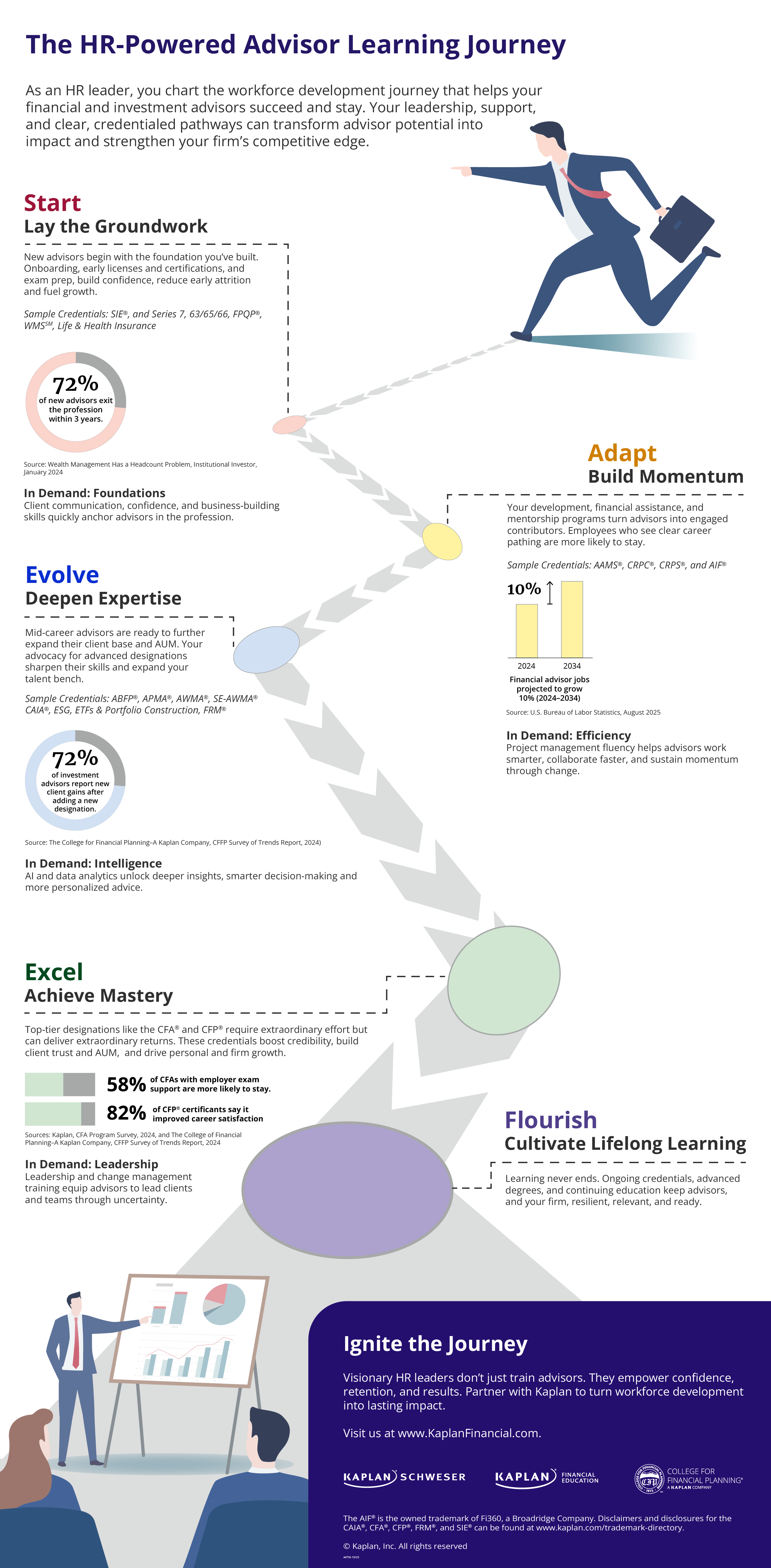

The HR-Powered Workforce Development Journey: Upskilling Financial Advisors for Growth and Retention

When HR integrates credential-based learning pathways and skill development into workforce planning, it transforms education into measurable outcomes. These outcomes include higher retention, faster time-to-productivity, and expanded assets under management. This article details how to construct an effective advisor workforce development journey across career stages to impact firm performance.

Download our development journey infographic for a comprehensive look at this strategic approach and transforming workforce development into firm performance.

1. How should firms support new financial advisors in their first year?

The first year sets the tone for success. Foundational credentials such as the SIE®, Series 7/63/65/66, FPQP®, and WMSSM help advisors build confidence and meet regulatory requirements. Structured onboarding that integrates exam prep, mentoring, and clear role expectations keeps early turnover low.

2. How can firms build momentum for mid-career advisors?

Once advisors establish foundational competence, development is ready to evolve. Consider career pathing, mentorship, and firm support for credentials such as AAMS®, CRPC®, CRPS®, and AIF®. These designations deepen planning and fiduciary skills while signaling long-term opportunity.

3. Which advanced credentials expand advisor expertise and client impact?

Encourage experienced advisors to pursue specializations that elevate their analytical and advisory skills. Credentials such as ABFP®, APMA®, AWMA®, SE-AWMA®, CAIA®, FRM®, and ESG credentials develop portfolio sophistication, alternative-investment fluency, and risk-management capability.

Learn Why Alternative Investment Education Is the Next Competitive Advantage By Downloading Our White Paper

How do elite certifications like CFA® and CFP® affect advisor retention and leadership?

High-level designations like the CFA® and CFP® require substantial dedication, yet this commitment delivers powerful outcomes for both advisors and the firm. The specialized knowledge gained reflects an advisor’s deep expertise and commitment to the profession, proving critical for expanding client bases and increasing assets under management.

5. What skills matter most across an advisor’s career journey?

Advisor success hinges on an evolving blend of soft and technical skills. In early career stages, a focus on confidence, communication, client trust-building, and business development can get new advisors off to a strong start. As advisors advance in their careers, efficiency, time and project management, and collaboration may prove vital alongside AI and data-driven insights. Integrating these dynamic skill sets into career development helps firms cultivate well-rounded professionals capable of adapting to market changes.

6. How can firms sustain long-term advisor growth?

Continuous learning is the differentiator. Encourage and track ongoing CE. Promote graduate study, and emerging-skills training in analytics, ESG investing, and AI-driven portfolio management. Firms that embed lifelong learning into culture stay resilient, relevant, and ready for what’s next.

7. What do all of these credential acronyms stand for and what do they mean?

Here’s a sample guide and cheat sheet for reference.

Acronym | Credential Name | Focus Area |

| AAMS® | Accredited Asset Management Specialist | Portfolio construction |

| ABFP® | Accredited Behavioral Finance Professional | Investor psychology |

| AIF® | Accredited Investment Fiduciary | Fiduciary standards |

| APMA® | Accredited Portfolio Management Advisor | Advanced portfolio design |

| AWMA® / SE-AWMA® | Accredited Wealth Management Advisor / Sports & Entertainment | High-net-worth clients |

| CAIA® | Chartered Alternative Investment Analyst | Alternatives & private markets |

| CFA® | Chartered Financial Analyst | Global investment analysis |

| CFP® | Certified Financial Planner | Comprehensive planning |

| CRPC® | Chartered Retirement Planning Counselor | Retirement strategies |

| CRPS® | Chartered Retirement Plans Specialist | Employer plan design |

| FPQP® | Financial Paraplanner Qualified Professional | Client support basics |

| FRM® | Financial Risk Manager | Risk management |

| Series 7/63/65/66 | FINRA Licensing Exams | Core investment roles |

| SIE | Securities Industry Essentials | Foundational licensing |

| WMSSM | Wealth Management Specialist | Investment fundamentals |

How to Develop a Workforce Training Plan in Financial Services

A 6-Step Guide for HR & Learning and Development Leaders

In today’s financial services landscape, the ground is shifting fast. AI is accelerating change across every function, regulatory updates are constant, and both your workforce and your clients are undergoing generational transformation. The result? Business as usual is no longer a viable strategy for long-term success.

What’s needed now is a more strategic, agile approach to learning and development—one that meets today’s business demands, while moving the business forward. That’s where workforce development comes in.

More than just skills training, a workforce development plan builds a talent pipeline that’s both future-ready and resilient. It combines corporate education programs, structured credentialing, hands-on learning, and data-backed planning to elevate both employee performance and business outcomes.

This guide breaks down how to design a corporate training program tailored to the financial services sector. Whether your goal is to upskill for AI, increase assets under management (AUM), better serve next-gen clients, or all three, this roadmap will help you launch a program that’s built to last.

Step One: Align Workforce Goals with Business Strategy

Every effective workforce development plan starts with the same question: Where is the business going—and what skills will employees need to get there?

This step is all about grounding your learning strategy in a business context. Start by reviewing your firm’s growth roadmap. Is expansion on the horizon? Are you exploring new lines of business or technologies like AI and machine learning? These shifts should directly inform the focus of your employee education programs.

Next, conduct a skills gap analysis mapping your current capabilities against future needs. For example, with client interactions increasingly digital, advisors may need support in areas like AI fluency, behavioral finance, or digital compliance rules. Certifications such as the Chartered Financial Analyst (CFA), Certified Financial Planner (CFPⓇ), or Chartered Alternative Investment Advisor (CAIAⓇ) may also factor in.

As you prioritize upskilling and reskilling needs, tie every learning outcome back to a business metric.

- AUM growth

- Client retention

- Regulatory outcomes

When corporate training programs support actual strategic goals, they’re easier to fund—and easier to scale.

Finally, don’t go it alone. Talk with key stakeholders, including team managers, to gather vital input. Their support will be critical in obtaining leadership buy-in.

Learn Why Alternative Investment Education Is the Next Competitive Advantage By Downloading Our White Paper

Step Two: Build Career Paths That Drive Retention and Results

Employees want to know that the work they’re doing today is building toward something bigger tomorrow. That’s why a cornerstone of effective workforce development is the creation of clear, credential-aligned career paths.

Think of these as blueprints for internal growth. They help employees see how their current role connects to advancement—and what corporate education solutions can help them get there. For example, an early-career advisor might pursue a CFA, while a senior team member might explore a CFP or a behavioral finance designation.

When you design career pathways, consider both technical and interpersonal competencies. Technical credentials are essential, but so are future-ready skills like adaptability, critical thinking, and client communication—especially in an environment shaped by digital transformation.

Keep in mind: These paths aren’t one-size-fits-all. Employees across departments, tenures, and roles will need tailored options. And they shouldn’t be static. Revisit them regularly to reflect changes in the industry and in your firm’s strategic direction.

As you know, career development is an employee retention strategy. But it's more than just staying. When employees feel they’re being invested in, they’re more likely to grow and lead.

Step Three: Implement Real-World Readiness Initiatives

Learning doesn’t stick unless it’s lived. That’s why the best corporate training programs immerse employees in real-world applications. Such initiatives build confidence, accelerate understanding, and bridge the all-too-common gap between learning and doing.

Simulations and case studies are a great place to start. These tools give employees space to experiment and apply concepts in a risk-free environment. Whether you're training on ethics or a new portfolio platform, scenario-based learning encourages critical thinking and real-time decision-making. Developing these “soft skills” is critical; they build agility and adaptability.

Coaching and mentoring programs are another proven tactic for improving retention and readiness. High-performing firms often pair new hires or career changers with seasoned professionals. These relationships foster knowledge transfer, build internal networks, and reinforce a learning culture across generations.

Finally, in today’s fast-paced, distraction-filled world, modular learning, including micro-certifications, offers significant advantages by growing employee knowledge with short-term achievements, which can contribute to sustained motivation. Meanwhile, the staggered delivery of courses gives individuals time to apply learned concepts directly in their work, increasing the retention and impact of micro-learning initiatives.

Step Four: Choose the Best Partners and Platforms

Even the most well-crafted training program will falter if the infrastructure can’t support it. That’s why choosing the right platform and partner is critical when designing your corporate training program.

Start by looking for external partners who can offer end-to-end business education programs. Narrow providers to those who understand your industry, make customization easy, and offer more than just content delivery—think educational insight, certification alignment, and timely data analysis.

Then, turn your attention to platforms themselves. The best corporate education solutions support multiple learning modalities, allowing for self-paced study, instructor-led sessions, and mobile-first experiences. Also look for partners who offer real-time dashboards so you can measure and report on progress, performance, as well as track ROI.

Considerations for your vendor checklist:

- Do they offer industry-specific content?

- How widely can I customize the solution?

- How do they support employee engagement and completion?

The best-fit partner prioritizes flexibility, customization, and certification prep—ensuring your employees gain not just knowledge, but credentials they can apply to grow the business and themselves.

Step Five: Communicate and Launch Your Programs

You’ve identified skills gaps and career paths. You’ve chosen the platform. Now, you need your people to use them. No easy task.

Internal communication is your launchpad. Successful L&D rollouts begin with clear, engaging messaging. Be sure to include language that links program participation with career advancement. When employees see that completing a training track or earning a certification unlocks new roles, higher pay, and greater influence, participation and completion rates rise.

Then develop a launch campaign that communicates:

- What’s coming—or changing—and why.

- How the program supports employees’ futures.

- What’s expected and what support is available.

Be sure to take advantage of all available internal channels to showcase the program and build enthusiasm: town halls, team meetings, intranet posts, digital signage, etc.

Step Six: Monitor, Evaluate, and Iterate

Corporate training is not a set-it-and-forget-it proposition. To succeed, your workforce development programs must evolve as your industry and business do. You can best ensure this adaptation of employee training and development programs by:

- Tracking participation and completion rates.

- Gathering workforce feedback via surveys or pulse checks.

- Identifying patterns of success or attrition.

Now, analyze the findings. You might ask yourself: Do these results correlate with business outcomes? Are certified employees retaining more clients? Are team leaders who completed training seeing better productivity scores?

Your measurement model should align with the KPIs you established in Step One, while also leaving room for discovery. Sometimes, programs yield benefits you didn’t expect—like improved collaboration across departments or greater employee satisfaction.

Most importantly, build a culture of iteration. Collaborate with your internal stakeholders and your education partner to update training content regularly. You want to guide and implement programs that shift with business strategy—especially as the industry navigates AI, personalization, and changing investor behaviors.

Leaders who continually refine their employee education programs not only stay competitive—they stay ahead.

How to Overcome Five Common Training “Challengers”

Every HR and L&D department hits friction when proposing, developing, and rolling out a workforce development plan. Success lies in early identification and planning for the challengers. Early identification and preparation are key to overcoming five common “challengers” and turning skeptics into supporters.

Challenger 1: The Resister

Some employees—and their managers—see new learning programs as disruptive to their day-to-day work and team goals. Break through by bringing them into the process early. Share the purpose behind the initiative, not just the tactics. Combine data with real stories to show how corporate training grows both the individual and the business. When people understand the “why,” they are far more likely to buy into the “what.”

Challenger 2: The Unengaged Employee

Relevance is what sparks engagement. Design training content that connects directly to an employee’s role and career goals, and offer it in formats they actually use, like video, interactive modules, or team workshops. You could even consider creating digital badges or gamified elements to transform training from a requirement into an achievement.

Challenger 3: The One-and-Done Thinker

Who hasn’t heard: “Another training? I just did one!” To combat this, emphasize that a single training session rarely delivers lasting change. Recognize and celebrate progress publicly, weave learning achievements into performance reviews, and show how continuing education impacts career advancement. Over time, repetitive messages such as these help develop cultures of continuous learning.

Challenger 4: The Time-Strapped Manager

When deadlines press, training often gets sidelined. The solution? Build learning into the natural flow of work. We call this connection point between learning and doing “middleware.” Using modular lessons and clear explanations of how training boosts productivity can make all the difference. Once managers see that learning can save time, not just drain it, adoption rises.

Challenger 5: The Budget Gatekeeper

Finance leaders may hesitate to approve spending without a clear return. Position education programs as investments in future growth rather than as line-item costs. Highlight how they reduce turnover, cut hiring expenses, and give the business a competitive edge through stronger skills. Benchmark data and case studies can reinforce the message. Most importantly, emphasize that the real risk lies not in investing—but in standing still.

Every HR leader will encounter skeptics, resisters, and competing priorities. What sets successful programs apart is the ability to anticipate these barriers and prepare strategies to overcome them. When obstacles are reframed as opportunities—to engage, personalize, measure, reinforce, streamline, and justify—training becomes not just a program but a lever for cultural change.

Conclusion

A workforce development plan is no longer a side project or HR initiative. It’s a growth strategy.

In a sector as complex and fast-moving as financial services, investing in corporate education programs is one of the smartest moves a firm can make. When done well, it fuels innovation, boosts performance, retains talent, and enhances client trust.

From conducting a skills gap analysis to designing targeted career paths, from rolling out simulations to tracking ROI—every step of this guide is designed to help HR and L&D leaders take action (see “How to Develop a Workforce Training Plan Checklist”) below. A dynamic, strategic workforce development plan is not just a response to disruption—it’s your competitive edge.

Whether you’re just beginning or you’re revamping, don’t delay: The future of financial services belongs to those who are ready—for anything.

How to Develop a Workforce Training Plan Example

Step One: Assess Current State and Future Needs

- Identify the business goals your workforce development strategy will support

- Conduct a skills gap analysis

- Calculate the ROI of your strategy (increased retention, greater AUM growth, etc.)

- Develop strong KPIs to ensure that leadership can readily review progress

- Present a clear vision of how your plan will support firm-wide goals

Step Two: Develop Custom Career Development Paths

- Map skills and certifications to career growth

- Align development tracks with business goals

- Prioritize future-ready skills like AI, analytics, and soft skills

- Encourage a growth mindset and continuous learning

- Revisit and revise paths as industry and business evolve

Step Three: Implement Real-World Readiness Initiatives

- Introduce simulations and case-based learning

- Launch coaching and mentoring programs

- Add micro-learning modules for agility and engagement

- Emphasize soft skill development and problem-solving

Step Four: Choose the Best Partners and Platforms

- Evaluate vendors for industry alignment and customization

- Ensure platform compatibility with existing systems

- Support multi-modal, inclusive learning formats

- Select vendors that offer ongoing updates and guidance

Step Five: Communicate and Launch Your Programs

- Create internal campaigns and toolkits

- Highlight advancement and career mobility

- Launch learning ambassadors and champions

- Make participation aspirational—not mandatory

Step Six: Monitor, Evaluate, and Iterate

- Track engagement and outcomes

- Measure impact across key KPIs

- Gather qualitative feedback

- Iterate based on changes in strategy and workforce needs

Don’t Wait to Build What’s Next

Leading HR and L&D professionals recognize the power of credentials as a guiding light. They illuminate the path forward for your teams, providing clarity and direction. A credential is more than just a resume entry—it signifies a growing workforce, forward-thinking employee development, and an organization evolving to lead rather than follow.

Explore how Kaplan's extensive range of financial education and professional development solutions can empower your workforce and foster growth. Contact us to discover more.

Strengthen the Bond: Why HR, L&D, and Managers Need to Unite on Corporate Upskilling

The modern talent landscape is undergoing a significant transformation, driven by employees’ demand for continuous learning and career advancement. Recent data from a Seismic study showed that 75% of Millennials and 79% of Gen Z employees would actively seek new roles if their employer didn’t offer upskilling opportunities.* This isn't just about careers—it's about a fundamental catalyst that powers individual, departmental, and organizational growth.

Yet many organizations still treat learning and workforce development as isolated events rather than as collaborative strategies. Even as they onboard the latest e-tech that teaches the latest in-demand skills, they still cling to old frameworks. To succeed, HR and Learning & Development (L&D) teams must bond together with team managers—who best understand employee needs—to embed continuous learning and professional certification into daily workflows.

Through this collaboration, HR and L&D can demonstrate strategic value by moving beyond transactional training programs to build an engaged and skill-ready workforce.

But to see real impact, the connection between learning, performance, and daily workflows needs to get a lot stronger and a lot more intentional.

Learn Why Alternative Investment Education Is the Next Competitive Advantage By Downloading Our White Paper

Corporate Training Elements for Success

The key to unlocking success lies in a strategic collaboration among HR, L&D, and managers. These three groups need to align together to identify the precise mix of knowledge, hard and soft skills, and capabilities required for long-term growth. Together they can formulate workforce development plans that are directly tied to financial career paths ensuring that every initiative is not only relevant, but also effectively integrated into employees' daily workflows.

In order to achieve optimal organizational performance, this collaboration must be purposeful. By aligning on critical skills and credentials, HR, L&D, and managers can craft powerful learning experiences that are seamlessly embedded into daily tasks. Instead of just designing workforce development programs, they make learning a part of everyday work and give employees the tools and upskilling opportunities when they need them. When managers see tangible benefits, such as increased productivity and engagement, they can become powerful advocates for continuous learning investments.

A Case for Collaboration: Sealing Leaks in the Financial Talent Pipeline

The financial services industry is grappling with a significant talent crunch that’s threatening long-term stability. Nearly 71% of new financial advisors leave the industry within five years, according to a 2025 report by Cerulli Associates. This high attrition rate is colliding with a demographic shift—38% of financial advisors, who manage 42% of industry assets, are likely to retire within the next decade, according to McKinsey & Company. This combination is putting serious pressure on HR and L&D leaders to rethink how to upskill employees and retain them.

The challenges that sit between “hire” and “retire” only add to the pressure. Certifications and licensure are often required milestones on that path, but too many employees are left to navigate them alone—without support, study time, or long-term career guidance. Solving for the entire hire to retire journey will require synthesizing isolated efforts across HR, L&D, and managers. That includes structured support for licensure and certification such as dedicated time for exam preparation, access to test prep resources and clear communication on how each credential supports their career advancement. This integrated approach is crucial for building a strong financial talent pipeline.

The Potent Compound of Partnership

Organizational and individual growth happens when employees see a clear future—and have the tools necessary to reach it. When they’re supported in building new skills and earning industry credentials, confidence rises, performance improves, and retention strengthens. Structured learning paths, allocated study time and financial support for certification prep all play a role. For people and learning leaders these tools and support systems are a key driver of employee engagement and loyalty.

HR and L&D may design the employee training programs, and managers may guide the day-to-day, but lasting impact happens when they work together. Their collaborative efforts ensure that learning fits the needs of the business and the realities of the team. This partnership is a potent compound that transforms individual potential into collective success.

Discover how Kaplan's comprehensive suite of financial education and professional development solutions can empower your workforce and drive growth. Contact us to learn more.

How to Prove the Effectiveness of Your Corporate Training Solutions

As an HR or L&D leader, you invest significant time, money, and effort into your employee training programs. Your leaders, in turn, expect to see a return on this investment. Proving ROI is crucial, but it's equally important to identify which aspects of the training work best at driving results.

This blog post will guide you through defining what success truly looks like for your workforce training initiatives, exploring why professional development is a dynamic process, and providing key questions to help you build a robust strategy that ensures your corporate training solutions deliver measurable impact.

Corporate Training Solutions ‒ What to Measure and Why

As a client commissioning learning how will you determine effectiveness? Start with a well-defined vision (see checklist below) and identify the workforce training success metrics to support your strategic goals. Defining what success looks like is the first step in implementing impactful corporate training solutions. Here are a few metrics you might consider:

- Completion rates

- Employee engagement

- Productivity increases

- Application in day-to-day work

- Exam passage rates

- Employee retention and attraction

The only “right” thing about a metric is its ability to reveal the effectiveness or ineffectiveness of your learning program. This is always based on your own strategic plans.

Learn Why Alternative Investment Education Is the Next Competitive Advantage By Downloading Our White Paper

Development Is a Process, Not a Performance

The next step is to be practical about what can be achieved and by when.

Learning is a process—one of exploration and experimentation, reflection and consolidation, application and personalization. It is not a performance where we ditch our existing ways for new ones. This understanding is crucial for any effective workforce training initiative.

Adult educators have long known this. They expend a lot of effort finding ways to encourage learners to identify and explore the habits and assumptions that underpin their current thinking. Successful career development depends on this identification. If educators cannot help learners understand their own processes and apply new perspectives, workers may filter and distort the new learning through the lens of their existing assumptions or, at worst, reject the new learning completely.

Unlike teaching young children, adult learners come to workforce training fully formed with experiences, opinions, and engrained habits. Strong corporate training solutions have adult educators seasoned at identifying behaviors that require a nudge, not just teaching course material. The end result is workers who come out of learning programs with new ways of thinking about themselves that they can then apply to future training.

From Investment to Impact

Ultimately, proving the effectiveness of your corporate training programs isn't just about ticking boxes; it's about strategic foresight and continuous improvement. By truly understanding what you want to measure and recognizing that professional development is an ongoing journey, not a one-time event, you can ensure your workforce training investments genuinely contribute to your organization's success. How might a more intentional, process-oriented approach to your employee training programs transform your own organizational outcomes?

Now It’s Your Turn: 20 Prompts to Help You Build a Workforce Training Strategy

Knowing how to measure the impact of your training programs starts with asking the right questions. The following prompts provide you with a structured approach to developing a workforce training strategy, determining metrics, and identifying areas for improvement across business, job-specific, and individual employee objectives.

Business objectives

- What are the strategic growth objectives that the learning will advance?

- What new capabilities need developing or enhancing?

- Where does employee retention sit on executive scorecards?

Job-specific objectives

- How is the job role changing now and what will it look like in the next three years?

- What roles does my skills gap analysis identify as needing attention?

- Do I have current employees who I can upskill or reskill?

- Does this role require new or additional certifications or licensure?

Training and development objectives

- What workforce training will support the business and job objectives?

- Can I do the training in-house or do I need a corporate learning solution?

- What is my implementation strategy?

- much of my budget should I allocate to the training?

- What does the training need to cover?

- How do I plan to evaluate the success of the training?

- How will I prove ROI?

Employee objectives

- Do I ask employees to self-identify the need for this training? Or is it mandatory?

- Does this learning easily snap into employee development plans?

- Do my people learn better from in-person training or virtual?

- Do I need to take generational differences into consideration?

- Should we make accommodations, such as PTO, to help employees finish the training or study for a certification or licensure exam?

- Is our current culture supportive enough for employee empowerment and success?

Discover how Kaplan's comprehensive suite of financial education and professional development solutions can empower your workforce and drive growth. Contact us to learn more.

Credentialing: Verified Skills Can Set Your Finance Team Apart

In business, the long-standing approach has been simple: hire bright minds, help them grow, and reward performance. That still matters—but it’s no longer enough. In today’s fast-moving environment, knowledge needs to be backed by something tangible. Certifications, licenses, and micro-credentials are becoming the currency of competence. For financial services firms, building a credentialing strategy isn’t just a smart move—it’s a competitive necessity.

HR and L&D leaders today are being asked to do more than upskill current employees or attract new talent. Clients expect expertise. Regulators demand precision. And inside the organization, everyone wants confidence that their teams are equipped for what’s next.

So, what does that shift actually look like? It’s an effort to move beyond one-off training sessions and toward structured learning that leads to measurable, verifiable skills. Whether it’s a Series 7 license, a CFAⓇ Charter, or an ESG micro-credential, these achievements bring value across the board.

It’s time to treat modern careers in finance more like an investment portfolio than a ladder. You need to diversify, rebalance regularly, and make strategic choices based on what the market—and your industry—is signaling.

The more you invest in market-relevant, verifiable skills—especially those aligned with financial services trends—the more resilient and agile your workforce becomes.

Learn Why Alternative Investment Education Is the Next Competitive Advantage By Downloading Our White Paper

Why Professional Credentials Matter More Than Ever

One of the biggest drivers behind verified skills is the rise of AI in financial services. From trading to fraud detection and risk assessment, artificial intelligence is transforming the way financial firms operate. And while general training has its place, the real advantage now lies in targeted credentials that validate specific competencies in AI, analytics, and compliance.

According to the Boston Consulting Group’s 2025, For Banks, the AI Reckoning Is Here report, only 25% of banks have fully scaled their AI efforts. The top barrier? Employee readiness. Unfortunately, many firms still lack a clear strategy for building AI literacy, governance knowledge, or applied skills within their teams.

Using credentialed learning paths to close skills gaps and put innovation into practice offer direction. But they aren’t just a map—they’re a GPS. They don’t just tell you where the industry is—they help you guide your people in real time to where the industry is going.

Credentials That Matter Now

With time at a premium, more firms are turning to fast, stackable micro-credentials to validate readiness in critical areas such as:

- AI Risk & Compliance. Train your team to identify anomalies, implement safeguards, and manage automated systems with confidence.

- Data Analytics. Build hands-on expertise in tools like Python, Tableau, or machine learning for financial modeling.

- ESG & Sustainable Finance. Equip professionals to lead in reporting, risk scoring, and governance amid rising regulatory pressure.

- AI Governance & Ethics. Prepare compliance, audit, and IT staff to utilize AI responsibly and transparently in high-stakes environments.

These programs provide HR and L&D leaders with the tools they need to translate fast-changing financial services trends into real, measurable capability.

Stackable Credentials, Scalable Impact

For learning leaders, the goal isn’t just to deliver training—it’s to build a culture of continuous, credential-backed development. That means creating clear pathways to career growth and business impact.

3 Ways to Accelerate Workforce Development with Micro-Credentials

- Deliver role-specific training that reflects real responsibilities

- Focus on practical use cases, not just theory

- Work with trusted partners to create stackable credentials that build and prove competencies and confidence

When employees earn credentials, they’re not just boosting their resumes—they’re strengthening your organization’s ability to adapt. And when a credential mindset takes hold across teams and departments, the benefits multiply.

Don’t Wait to Build What’s Next

Top HR and L&D leaders see credentials as a flashlight in the fog. They help you and your teams see what’s next—and walk toward it with clarity. In the end, a credential isn’t just a line on a resume—it’s proof that your workforce is growing, your employee-development leadership is forward-looking, and you’re helping evolve your organization into one that is built to lead, not follow.

Discover how Kaplan's comprehensive suite of financial education and professional development solutions can empower your workforce and drive growth. Contact us to learn more.

CFA Institute does not endorse, promote, review, or warrant the accuracy or quality of the product and services offered by Kaplan Schweser. CFA Institute®, CFA® and “Chartered Financial Analyst®” are trademarks owned by CFA Institute.

Beyond the Backup Plan: Why Succession Strategy Is a Growth Imperative

Succession planning isn’t just a backup plan—it’s become a core business strategy. In today’s unpredictable environment, where market volatility, evolving client demands, and demographic shifts converge, advisory firms need to think in the short term about long-term leadership continuity.

According to the 2023 Cerulli Associates U.S. Advisor Metrics Report, more than one-third of advisors are expected to retire within the next decade—but many firms are still unprepared. Waiting until a transition is imminent risks valuation missteps, client attrition, retention of top talent, and skills gaps that could have been avoided with earlier, more intentional planning.

Future-Proof Your Firm

To future-proof your firm, succession planning needs to extend beyond legal documents and ownership clauses. It means building internal leadership pipelines, actively developing successors, and strengthening client relationships through every transition stage.

Learn Why Alternative Investment Education Is the Next Competitive Advantage By Downloading Our White Paper

3 Questions to Ask About Succession Planning Right Now

1. Are Our Buyout Terms Still Viable in Today's Market?

Higher interest rates and tighter margins are reshaping firm valuations. Succession plans should reflect current economic conditions, advisor productivity, and credentialing timelines.

2. Have We Named—Not Just Identified—a Successor?

Clients value clarity. Publicly naming and empowering a successor helps preserve trust, especially when that leader is visible and involved in key relationships early on.

3. Is Our Transition Plan Relationship-Driven or Just Paperwork-Driven?

Clients notice the difference. A phased transition that includes mentoring, joint meetings, and shared planning responsibilities is far more effective than a handoff defined by signatures alone.

Final Thought

Done right, succession isn’t a disruption—it’s a growth opportunity. It keeps operations steady, preserves institutional knowledge, and reinforces your firm’s values and vision. In a crowded and competitive landscape, that kind of continuity is a differentiator.

Supporting Your Organization Through Today's Challenges and Tomorrow's Growth

Kaplan is proud to be your learning partner with resources available to support the learning needs of your business. Let us know how we can help you and your employees navigate the challenging times facing us all.